Contractors vs employees: how to be sure your ‘contractors’ aren’t in fact ‘employees’

Date posted: Wednesday, April 9, 2014

It’s important that businesses know the difference between ‘independent contractors’ and ‘employees’ for superannuation, pay and workplace relationship obligations.

As a rule, contractors work and service organisations, while working in and for their own business. An employee however, completes this work whilst working in and for the employer’s business. A worker cannot be considered as an independent contractors simply because they have an ABN.

Other differences which can help employers determine whether a worker is an employee of an independent contractor are:

- The workers ability to sub-contract or delegate the task to other workers

- The basis of payment

- The equipment or tools which are provided by the employer

- The independence the worker has in carrying out their work

There are various issues that may arise if an employer wrongfully considers an employee as an independent contractor. These include employers not fulfilling their superannuation payment requirements or not maintaining fair work practices in terms of payment for service or dismissal.

Still not sure whether your workers are employees or contractors? You can find out more by giving us a call, sending us an email or booking in for a visit. We specialise in servicing individuals and businesses in the South Eastern Suburbs including Pakenham, Lakeside, Berwick, Nar Nar Goon, Garfield, Tynong and Koo Wee Rup.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

Xero Accounting x Pakenham Taxation + Accounting

Date posted: Wednesday, March 19, 2014

Via Xero Accounting we can work with you, no matter where you’re located. Thanks to “the cloud”, Xero easily connects Pakenham Taxation + Accounting to your business – making it easy for us to assist you with a range of accounting and bookkeeping needs.

So what exactly is “the cloud”? Well to put it simply it can be software, a platform or infrastructure, which is run remotely via the Internet. This means files, programs and applications can be used by a number of people over the net – without the need to download or update software on each individual’s computer.

As a Xero certified accountant, Pakenham Taxation + Accounting provide businesses with an online accounting and payroll management system. We can manage your Xero account for you, work collaboratively with you via remote access or coach you to use Xero – it’s up to you and the needs of your business.

What else can we do through Xero? Xero makes it easy to pay bills, keep track of expenses and invoices, create up-to-date reports and stay on top of spending through the use of easy-to-use budgeting tools.

If you want to know more about Xero, give us a call, send us an email or book in for a visit. We specialise in servicing individuals and businesses in the South Eastern Suburbs including Pakenham, Lakeside, Berwick, Nar Nar Goon, Garfield, Tynong and Koo Wee Rup.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

Recent Changes to Parental Leave Pay

Date posted: Wednesday, March 5, 2014

If you’re expecting a baby or if you’ve already recently welcomed that new addition to your family you might be asking yourself …

Can I still claim the baby bonus?

On the 1st of March 2014, the distribution of the Baby Bonus officially ended. Parents who have a newborn baby or adopt a child after this date are now eligible for Parental Leave Pay or the Newborn Upfront Payment.

How do the changes to the Baby Bonus effect Parental Leave Pay?

Despite the scrapping of the Baby Bonus, no changes have been made to Parental Leave Pay. This payment will continue to be calculated based on the National Minimum Wage and equates to $622.10 a week, before tax.

Payments are made by employers or by the department of Human Services for self-employed new parents. For a maximum of 18 weeks, payments are deposited to parents on a fortnightly basis.

What does the government now offer instead of the baby bonus?

If you are ineligible or choose not to claim Parental Leave Pay for your newborn or adopted child, you may be eligible for the Newborn Upfront Payment and Newborn Supplement. Unfortunately, you cannot claim both payments.

The Newborn Upfront Payment and Newborn Supplement rate and eligibility is based on an income test as well as other factors. For those who qualify, the maximum amount paid is $2001.50 for a first child and $1000.50 for following children.

Still have questions? You can find out more by giving us a call, sending us an email or booking in for a visit. We specialise in servicing individuals and businesses in the South Eastern Suburbs including Pakenham, Lakeside, Berwick, Nar Nar Goon, Garfield, Tynong and Koo Wee Rup.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

What’s the Fringe Benefits Tax (FBT) and How Does it Impact Me?

Date posted: Wednesday, February 19, 2014

As an employer, you are required to pay a tax on non-cash (or fringe) benefits provided to employees. These benefits include services and privileges allowed to employees as well as physical goods.

What is classified as a ‘fringe benefit’?

To put it simply, benefits provided to an employee because they are an employee are considered to be a ‘fringe benefit’. This includes giving employees:

- Company cars for personal use

- A cheap or discounted loan

- Private health insurance

- Entertainment in the form of meals or recreational activities

What is not classified as a ‘fringe benefit’?

Employers are not required to pay FBT on the following goods and services:

- Employee relocation expenses

- Superannuation

- Work related items such as protective clothing and tools

How does this impact me?

Whether you’re an employee or employer the Fringe Benefits Tax impacts you. While employers pay the FBT, fringe benefits must also be reported on an employee’s PAYG payment summary and tax return.

Still have questions? You can find out more by giving us a call, sending us an email or booking in for a visit. We specialise in servicing individuals and businesses in the South Eastern Suburbs within the Cardinia Shire.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

What Happens If My BAS Is Late?

Date posted: Wednesday, February 5, 2014

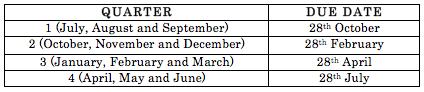

Now that you’ve read our handy table on this financial year’s BAS deadline dates, we bet you’re asking yourself ‘what happens if I don’t get my BAS in on time?’

To put it simply, if a business doesn’t lodge their BAS before the specified dates, the ATO may issue a failure to lodge penalty.

While your next question may be ‘how much are the penalties for getting your BAS in late?’, fines differ based on the size of the business, the length of delay in lodging and the lodgement history of the business.

If your business is unable to pay their tax instalment on time, they are still required to lodge an activity statement by the specified deadline. For companies in this position, a deferral of payment or payment arrangement is possible.

Still have questions? You can find out more by giving us a call, sending us an email or booking in for a visit. We specialise in servicing individuals and businesses within the Cardinia Shire and outer south-east suburbs including Pakenham, Berwick, Cranbourne, Officer, Beaconsfield, Garfield, and Drouin.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

When Is My BAS Due?

Date posted: Tuesday, January 21, 2014

So you want to know the answer to…

- Does my business need to submit a BAS?

- When do I need to submit my BAS?

- What are the BAS submission dates?

- What are the cut-off dates to submit my BAS?

Firstly, all Australian businesses are required to submit a Business Activity Statement (BAS) in order to report their taxation obligations.

Small businesses have different obligations to large businesses so activity statements are tailored to individual companies. GST, PAYG and Fringe Benefits Tax (FBT) are all potential inclusions on a company’s statement.

While the type of BAS form being completed by an organisation may vary, the required payment dates when lodging quarterly do not.

Still confused? Just follow Pakenham Taxation + Accounting’s simplified table below and get your BAS in before the specified dates. Easy-peasy.

For businesses that report and pay monthly, no need to stress. The Australian Tax Office has chosen the 21st day of the following month as the designated day for lodgement.

Still have questions? You can find out more by giving us a call, sending us an email or making an appointment. We specialise in servicing individuals and businesses within the Cardinia Shire and outer south-east suburbs including Pakenham, Berwick, Cranbourne, Officer, Beaconsfield, Garfield, and Drouin.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

What Can I Claim on Tax?

Date posted: Thursday, January 2, 2014

Are you planning on claiming your new iPad as a tax deduction? Thinking you’ll claim your latest shoe splurge on your next tax return? Or are you just too confused to try and claim anything at all? We don’t blame you.

Tax return time can be overwhelming. Questions of what you can and cannot claim are endless. Here are just a few, we get asked daily…

- Can I claim my new dress as a deduction on tax if I bought it for a work event?

- Can I claim my work shoes on tax if they are work boots only?

- Can I claim tools and equipment I bought for work on tax?

- Can I claim my holiday on tax if I had to do some work while I was there?

…and the answers can sometimes seem even more confusing.

Save yourself the iPad/shoes/family getaway post-purchase regret and read Pakenham Taxation’s list of what you can and cannot claim on your tax.

What you CAN claim:

- Work travel expenses. This includes meals and accommodation while on a business trip, the cost of travelling between two workplaces and the cost of transportation of tools or equipment used for work.

- Occupation-specific clothing. The cost of uniforms, protective clothing and other items only worn for work purposes are all included. The costs associated with cleaning and maintaining ALL work clothes are also tax deductable.

- Tools, equipment, trade books or journals and other items required to fulfil a job or earn income. Calculators, Computers (this includes iPads!), filing cabinets and technical equipment are all included. Even better news; the costs of repairing or insuring these items can also be claimed!

What you CANNOT claim:

- Private travel. This includes costs associated with travelling to and from work as well as family holidays. This means if you’re planning on claiming your Hawaiian getaway as a tax deduction by slipping into a Waikiki conference for a few days, think again.

- Most clothing items. Unfortunately, if your employer requires you wear clothing of a certain brand, style or colour this is not tax deductable. The rule of thumb when it comes to claimable clothing is if your outfit makes your profession easily distinguishable (i.e. a chef’s uniform) then you can most likely claim it, otherwise it’s a no-go.

Still have questions? You can find out more by giving us a call, sending us an email or booking in for a visit. We specialise in servicing individuals and businesses within the Cardinia Shire and outer south-east suburbs including Pakenham, Berwick, Cranbourne, Officer, Beaconsfield, Garfield, and Drouin.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

What to Bring to your Tax Appointment

Date posted: Sunday, August 4, 2013

We’ve talked about SBE (small business entity) and non-SBE taxpayers, now it’s time to actually claim your tax. Here are some things you’ll need to bring with you when you come to your next tax appointment with us.

- Stocktake details as at 30 June

- Debtors listing (including a list of bad debts written off) as at 30 June.

- Creditors listing as at 30 June

Let us help you simplify your tax and accounting today. Give the Pakenham Taxation + Accounting team a call on (03) 5940 1836 and let one of the experts help you claim all your tax.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

Maximising Deductions for SBE Taxpayers: Prepayment Strategies

Date posted: Sunday, July 21, 2013

Continuing on from our last topic about maximising deductions for SBE (small business entity) taxpayers, we’ll now look at prepayment strategies.

So what does this mean for SBE taxpayers?

SBE taxpayers making prepayments before 1 July 2013 can choose to claim a full deduction in the year of payment where they cover a period of no more than 12 months (ending 1 July 2014). Otherwise, the prepayment rules are the same as for non-SBE taxpayers.

The kinds of expenses that may be prepaid include:

- Rent on business premises or equipment

- Lease payments on business items such as cars and office equipment

- Interest

- Business trips

- Training courses

- Business subscriptions

- Cleaning

Let the team at Pakenham Taxation + Accounting make life a little easier by helping you with all your end of financial year needs. Call the team on (03) 5940 1836 and make a booking today.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.

Maximising Deductions for SBE Taxpayers: Accelerating Expenditure

Date posted: Sunday, July 7, 2013

Over the last couple of weeks we’ve looked at non-SBE (non-small business entity) taxpayers and how they can maximise deductions. Now let’s take a look at how SBE taxpayers can do the same thing.

There are two ways in which SBE taxpayers can maximise deductions, one is by accelerating expenditure and the other is by prepaying deductible business expenses. This week we’re going to focus on accelerated expenditure.

So what is accelerating expenditure?

It’s where SBE taxpayers can choose to write-off depreciable assets that cost less than $6,500 in the year of purchase. Also assets costing $6,500 or more can be depreciated at 15% (which is half the full rate of 30%) in their first year.

If your business chooses to use the SBE depreciation rule it is effectively ‘locked in’ to using this rule for all depreciable assets.

Accelerating expenditure can be a little confusing and tricky. If you have any questions call us on (03) 5940 1836 and make a booking with one of the Pakenham Taxation + Accounting experts who can help you with all your tax, finance and accounting needs.