Date posted: Tuesday, January 21, 2014

So you want to know the answer to…

- Does my business need to submit a BAS?

- When do I need to submit my BAS?

- What are the BAS submission dates?

- What are the cut-off dates to submit my BAS?

Firstly, all Australian businesses are required to submit a Business Activity Statement (BAS) in order to report their taxation obligations.

Small businesses have different obligations to large businesses so activity statements are tailored to individual companies. GST, PAYG and Fringe Benefits Tax (FBT) are all potential inclusions on a company’s statement.

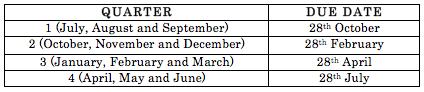

While the type of BAS form being completed by an organisation may vary, the required payment dates when lodging quarterly do not.

Still confused? Just follow Pakenham Taxation + Accounting’s simplified table below and get your BAS in before the specified dates. Easy-peasy.

For businesses that report and pay monthly, no need to stress. The Australian Tax Office has chosen the 21st day of the following month as the designated day for lodgement.

Still have questions? You can find out more by giving us a call, sending us an email or making an appointment. We specialise in servicing individuals and businesses within the Cardinia Shire and outer south-east suburbs including Pakenham, Berwick, Cranbourne, Officer, Beaconsfield, Garfield, and Drouin.

Sign up with Pakenham Taxation + Accounting to receive tips on how to better manage your personal and business tax.